Investors in VC/PE funds continue to look to emerging regions for new, attractive opportunities, especially with the European economy stagnating and the United States growing at a snail's pace.

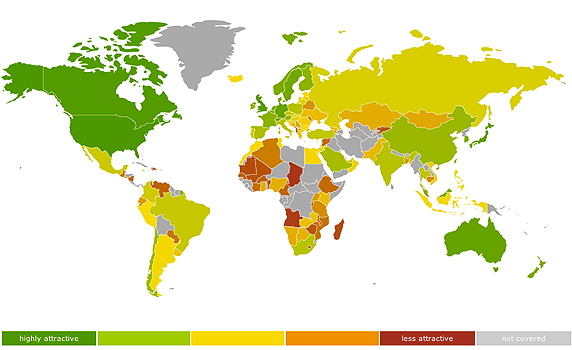

To help investors identify the best opportunities, IESE's Center for International Finance, in conjunction with Ernst & Young, has published its fourth annual Venture Capital and Private Equity Country Attractiveness Index. The 2013 edition includes two new entrants -- Belarus and Cambodia -- boosting the total number of countries surveyed to 118.

Closing the Gap

This year's top five remain unchanged from last year, with the United States again topping the ranking, closely trailed by Canada, the United Kingdom, Japan and Singapore. That said, the gap between these and other countries has narrowed considerably compared with previous editions.

All the same, the higher ranked core markets continue to tick more of the key boxes - with the obvious exception of economic activity. The United States, for example, usually ranks far ahead in the capital market.

For a country to have a high rank, it needs to achieve a high score on all of the criteria - something that continues to elude many of the world's emerging economies.

Other BRICS in the Wall

The index reveals recent strong investor interest not only in the BRICS (Brazil, Russia, India, China and South Africa) but also in other emerging economies such as Turkey, Mexico, Indonesia, Nigeria and the Philippines, suggesting that investors would be well-advised to expand their vision beyond what are often touted as the "hot" markets.

That said, the survey expresses reservations about these emerging markets, most notably in relation to the disequilibrium between exceptional growth opportunities and advanced financial market infrastructure.

This often comes at the high cost of disadvantageous investor protection, corporate governance, human and social environment, and entrepreneurial culture. Deal opportunities are also less developed in general.

Read full article on the IESE Insight website.